Table of Contents

A Stop Loss order is typically used to limit potential losses in case the price of an asset suddenly increases or decreases.

The stop value set in the form represents an entry or exit point for the market.

BUY stop loss:

- If the price rises above the stop the buying transaction is executed

- example: The current market price is 50,000 EUR for 1 BTC. If you set a Stop at 51,000 EUR to buy BTC worth 20,000 EUR, when the market reaches a price equal to or above 51,000 EUR, the buy order is executed (20,000 EUR worth of BTC is bought).If the market continues to rise (e.g. 52,000 EUR for 1 BTC), the stop order has made a profit.The price doesn’t have to be a condition, it can decrease immediately after the stop loss trigger.

SELL stop loss:

- if the price drops below the stop, the sell transaction is executed.

- example: The current market price is 50,000 EUR for 1 BTC. If you want to prevent potential loss, you can set a STOP at 40,000 EUR for 0.5 BTC. If the price drops to 40,000 EUR for 1 BTC, the sell stop loss order will be executed (0.5 BTC will be sold).

When the condition is met, the order is executed as a market order and may suffer from specific delays of this type of order (which also include price variations after the trigger, post-sale event).

Attention! execution rate can be both above and below the stop value. Stop only represents the trigger condition, not the execution value.

How do I add a Stop (Stop Loss) order ? #

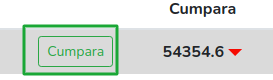

From the trading page, you must click on Buy or Sell:

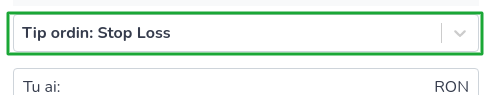

From the next list, select the Stop Loss order:

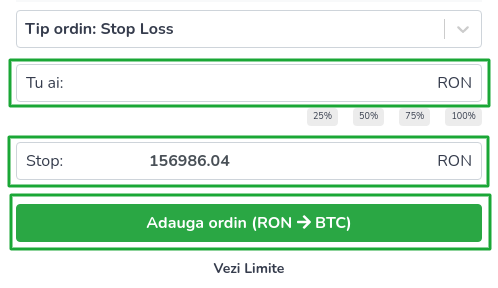

Enter the amount, stop condition and press Add Order.