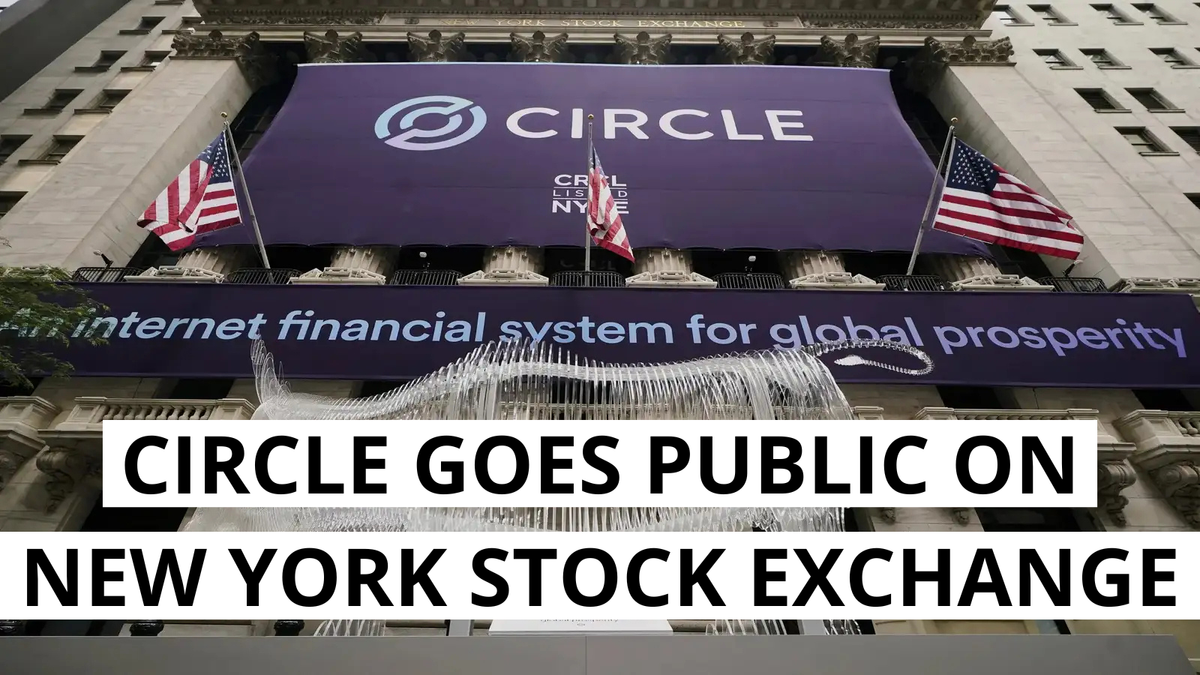

Circle goes public on NYSE with valuation soaring past $19 billion

Circle, the issuer of the USDC and EURC stablecoins, has gone public on the New York Stock Exchange, marking a significant moment for the crypto industry. The IPO was expanded for the second time, reflecting strong investor demand. The company raised the maximum share price to $31 and increased the total offer to 39.1 million shares, potentially raising up to $1.2 billion. Initially valued at $7 billion, the market cap quickly surged to over $19 billion within the first trading hours.

USDC, Circle’s stablecoin, is the second-largest globally, with $61.5 billion in circulation, while market leader Tether stands at $153.7 billion. Unlike Tether, Circle follows a regulated and transparent “onshore” model.

Beyond stablecoin issuance, Circle has expanded its financial infrastructure by launching the Circle Payments Network, a platform offering banking, FX, and liquidity solutions. These developments signal a clear move toward vertical integration.

However, the IPO also revealed notable internal moves: Circle’s CFO sold 75% of his shares, marking a significant personal capital exit.