Crypto analysis for BTC, ETH, EGLD, DOT and AAVE - May 29, 2025

Crypto market in the last 24 hours:

🌐 Market Cap: $3.42T (-0.39%)

📊 24h Volume: $130.31B (+9.67%)

💰 DeFi Volume: $40.96B (31.44% of total volume 24h)

🔒 Stablecoins Volume: $124.75B (95.72% of total volume 24h)

💵 Bitcoin Dominance: 62.9% (-0.57%)

Bitcoin (BTC) Analysis

BTC is looking bullish after forming a bull flag pattern, which increases the probability of a continuation to the upside. However, for confirmation, we need to see a structure similar to a W pattern forming from the current levels, followed by a breakout and candle close above the resistance zone at 108,499 USD. If this happens, potential targets are 109,992 USD and 111,303 USD. This scenario aligns with the current bullish momentum, but it's important to remain cautious and wait for clear confirmation before entering a position.

Ethereum (ETH) Analysis

ETH has taken out buyer liquidity, formed an ascending channel, and is showing bearish divergence—all of which increase the probability of a downside move. For confirmation, we need a breakdown and a candle close below the support zone at 2,462 USD. If this happens, price could move toward 2,355 USD and 2,227 USD. This setup signals a potential reversal from current levels, but any short positions should be considered only after proper confirmation.

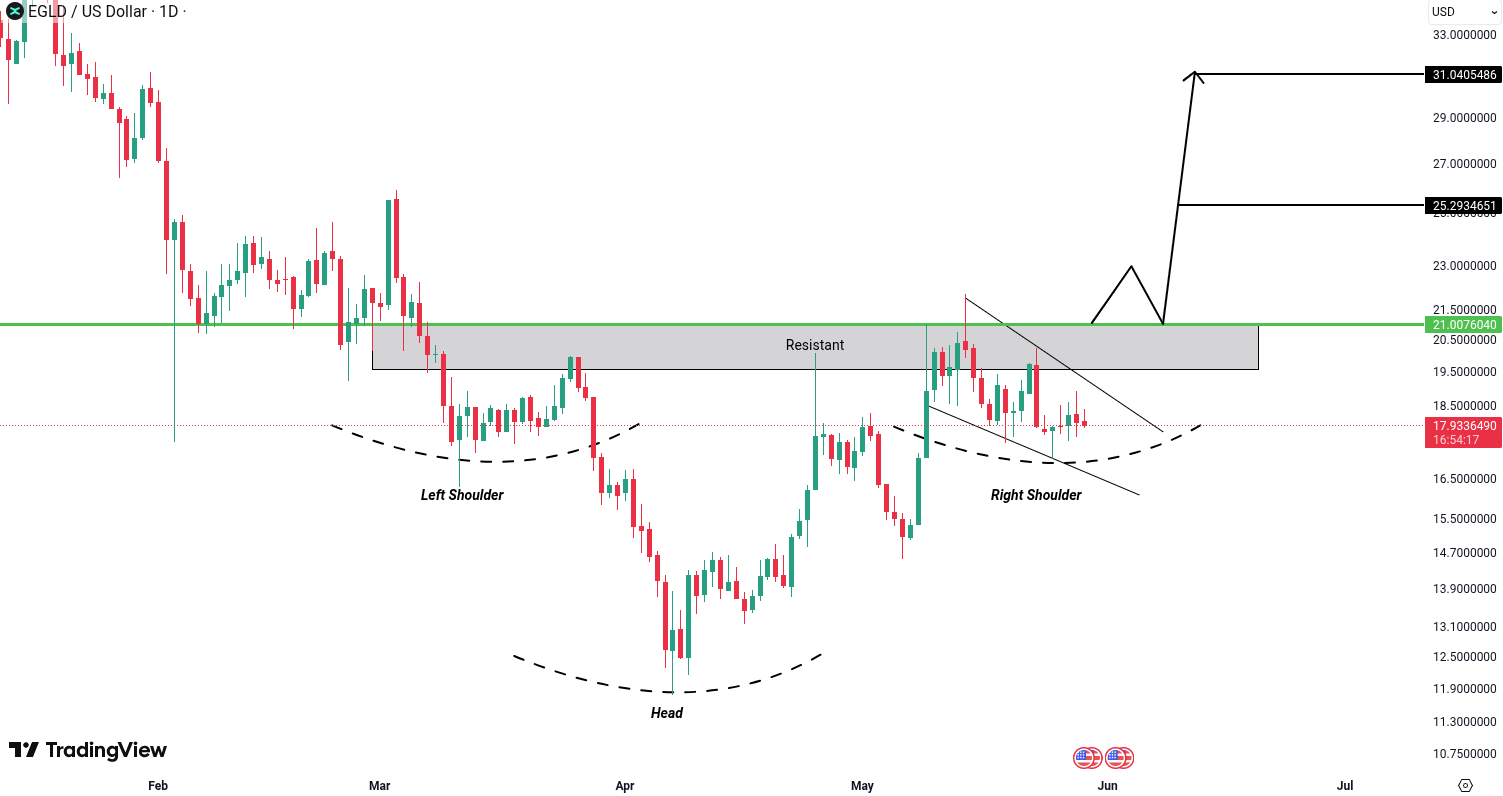

MultiversX (EGLD) Analysis

EGLD is showing potential due to the formation of an inverse head and shoulders pattern, which increases the probability of a bullish reversal from the current levels. To confirm this move, we need a breakout and candle close above the resistance zone at 21 USD. If successful, the price could rally toward 25.29 USD and 31.04 USD. It’s important to closely watch price action, as failure to break above this key level could lead to rejection and a continuation of the existing trend.

Polkadot (DOT) Analysis

DOT is currently consolidating after a bullish move, forming what looks like a bull flag pattern. This increases the probability of bullish continuation, but we need confirmation through a breakout and candle close above the resistance zone at 4.81 USD. If this level is broken, a rally could follow toward targets of 5.21 USD and 5.66 USD. However, if the breakout fails, price may continue to consolidate or retrace—so wait for confirmation before taking a position.

AAVE (AAVE) Analysis

AAVE is showing potential weakness after forming a rising wedge pattern, along with bearish divergence on the chart. This combination increases the likelihood of a bearish move, hinting at a possible reversal or correction. For confirmation, we need to see a breakdown and a candle close below the support zone at 256.78 USD. If this happens, a sell-off toward 245.58 USD and 233.53 USD could follow. Until then, the bearish setup remains high probability but needs confirmation through a clear breakdown.

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy or sell any of these cryptocurrencies using the free digital wallet. SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 100 cryptocurrencies, are all available in our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.