Crypto analysis for BTC, ETH, EGLD, LTC and ADA - June 05, 2025

Crypto market in the last 24 hours:

📉 Global crypto market cap: 3.29T USD (⬇️ -1.27%)

🔄 Total 24h volume: 102.83B USD (⬇️ -1.96%)

🌐 DeFi volume: 36.23B USD (35.23% of total)

💵 Stablecoins volume: 97.13B USD (94.45% of total)

🟠 BTC dominance: 63.26% (⬆️ +0.16%)

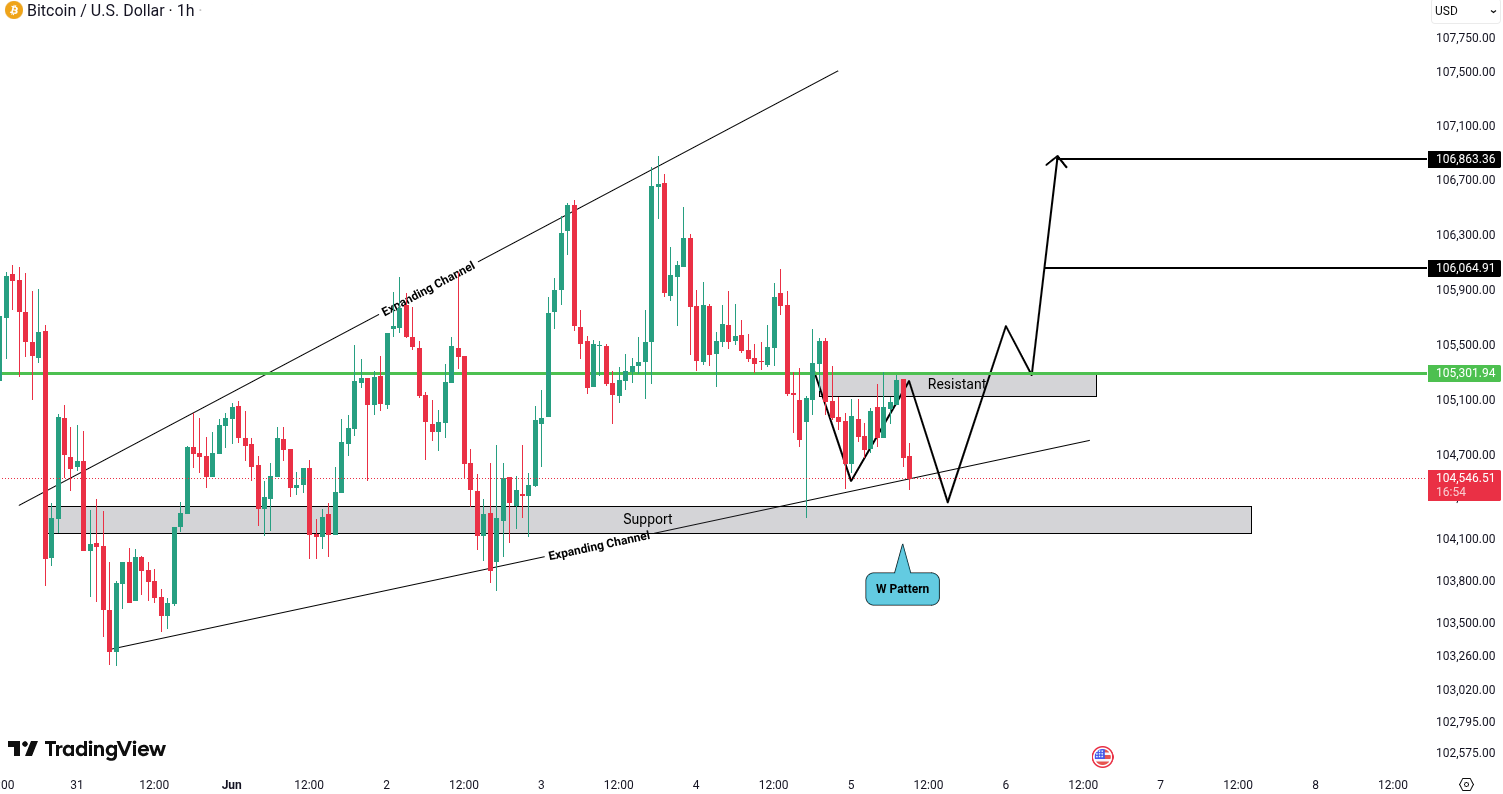

Bitcoin (BTC) analysis

BTCUSD has formed an expanding channel and is currently approaching a key support zone. If the price bounces from this level and then closes a candle above the resistance at 105,301.94 USD (approx. 96,954 EUR), it would confirm a W pattern breakout. This breakout could lead to bullish targets at 106,064.91 USD (approx. 97,665 EUR) and 106,863.36 USD (approx. 98,393 EUR). The expanding channel indicates high volatility, so a strong reaction from the support area with increased volume is crucial for validating the bullish scenario.

Ethereum (ETH) analysis

ETHUSD has formed a head & shoulders pattern along with bearish divergence, which increases the probability of a downward move. However, confirmation is needed via a breakdown and candle closing below the key support level of 2,579 USD (approx. 2,374 EUR). If this occurs, it would validate the bearish setup with potential downside targets at 2,543 USD (approx. 2,342 EUR) and 2,509 USD (approx. 2,311 EUR). This structure suggests that buyers may be losing momentum, and a confirmed breakdown could trigger further selling.

MultiversX (EGLD) analysis

EGLDUSD has broken down from an ascending channel, indicating a possible structural shift, but it hasn’t yet retested the breakdown level. If the price drops further and closes below the support at 14.56 USD (approx. 13.41 EUR), the bearish structure would be confirmed, raising the chances of continued downside. Next targets in that case are around 13.53 USD (approx. 12.47 EUR) and 12.20 USD (approx. 11.24 EUR). This setup suggests sellers are gaining control, especially if no strong bullish reaction appears at current levels.

Litecoin (LTC) analysis

LTCUSD has formed an expanding wedge pattern and is approaching a key support level at 82.11 USD (approx. 75.61 EUR). The confluence of this structure and the support increases the significance of price action here. If the price reaches this zone and forms a bullish candlestick—like a hammer, bullish engulfing, or morning star—it increases the likelihood of a bounce. With confirmation, potential targets are 85.14 USD (approx. 78.45 EUR) and 89.82 USD (approx. 82.80 EUR). However, failure to hold the support level would invalidate the bullish setup.

Cardano (ADA) analysis

ADAUSD has broken down from an ascending channel and also formed a head & shoulders pattern—both classic bearish signals. This combination significantly raises the probability of further downside. For confirmation, a clear breakdown and candle close below the key support at 0.642 USD (approx. 0.59 EUR) is needed. If that happens, targets could extend to 0.593 USD (approx. 0.55 EUR) and 0.542 USD (approx. 0.50 EUR). Until then, caution is advised as the support zone could still trigger a temporary bounce.

📈 Our Short-Term Estimates (96H)

Disclaimer: These are our personal opinions, not financial advice. We invest our own money — and sometimes we lose. DYOR!

- BTCUSD – 2% to 4% – UP – At minor support (Risky)

- ETHUSD – 2% to 4% – DOWN – Formed head & shoulders at resistance

- EGLDUSD – 2% to 4% – DOWN – Bear Flag

- SOLUSD – 3% to 6% – DOWN – Bear Flag

- LINKUSD – 2% to 4% – DOWN – Head & shoulders

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy or sell any of these cryptocurrencies using the free digital wallet. SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 100 cryptocurrencies, are all available in our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.