Crypto Market update and analysis for BTC, ETH, EGLD, ADA & EOS - November 30, 2023

Crypto Market in the last 24h

💰 Global crypto market cap: €1.3T (🔽0.44%)

📊 Total volume in last 24h: €41.05B (🔽22.22%)

🌐 DeFi volume: €4.62B (11.25% of total crypto volume)

💱 Total stablecoin volume: €35.44B (86.35% of crypto volume)

₿ Bitcoin dominance: 51.89% (🔽0.18%)

Bitcoin (BTC) Analysis

BTC/EUR is currently showing a bullish stance, consolidating comfortably above the rising wedge pattern in the weekly timeframe. Based on the present price action, a probable scenario involves a retest of the upper trendline of the rising wedge and the 15 EMA. If the price manages to break above the level of 35,843 Euro, we can anticipate further bullish momentum, targeting levels around 39,319 Euro and 42,500 Euro.

Ethereum (ETH) Analysis

ETH/EUR is forming a W pattern on the weekly timeframe, a bullish signal that gains strength considering the formation of patterns on larger timeframes. To confirm this optimistic scenario, a breakout above the level of 2,000 Euro is essential. This breakout could open the way for target levels of 2,357 Euro and 2,601 Euro.

MultiversX (EGLD) Analysis

EGLD/EUR is forming an inverse head and shoulders pattern, indicating a potential bullish scenario. This pattern illustrates a shift from lower lows to higher highs, suggesting a reversal in the trend. To confirm this pattern, a breakout above the level of 53.38 Euro is needed. Once this breakout occurs, we can anticipate targets at 65.94 Euro and 82.01 Euro. Traders should keep a close eye on these developments for strategic decision-making.

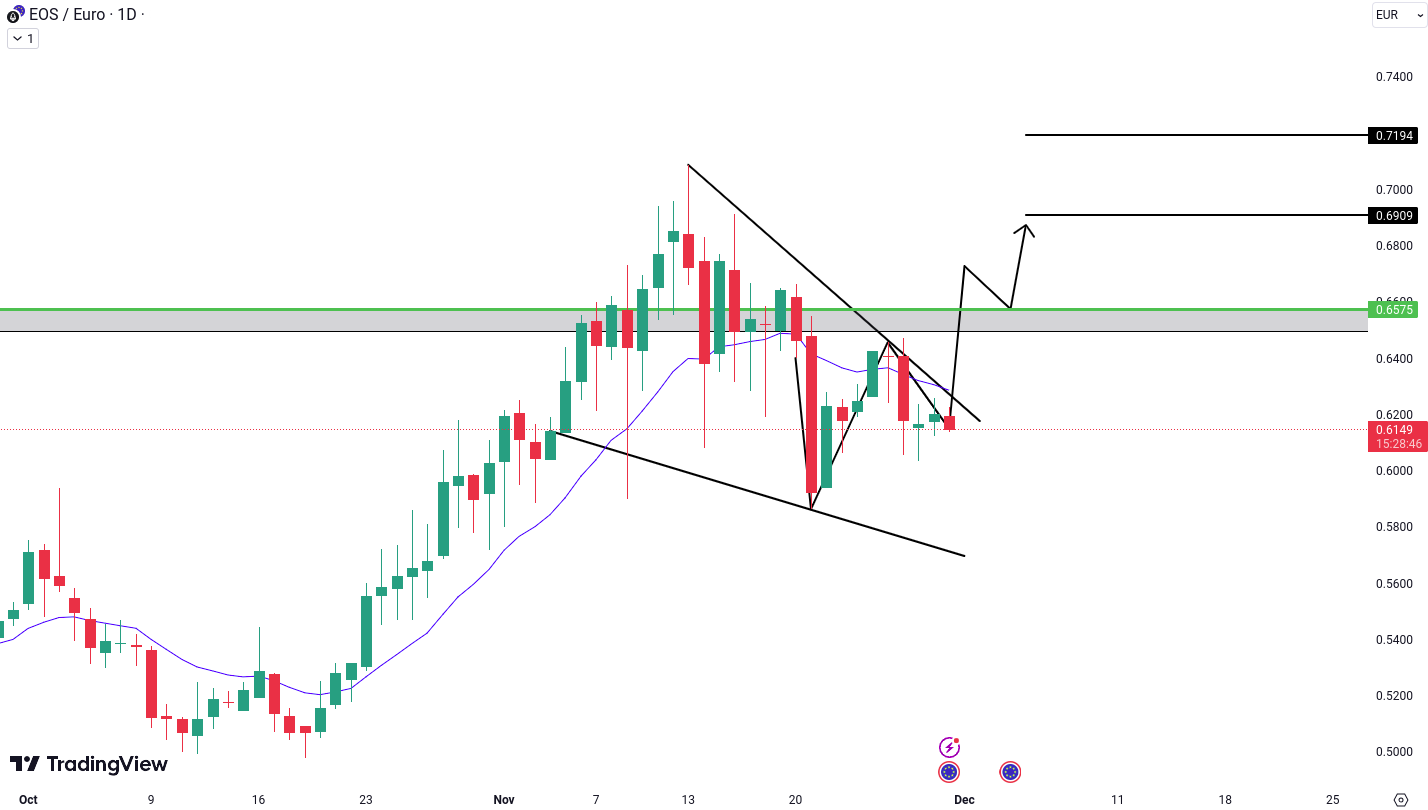

EOS (EOS) Analysis

EOS/EUR has formed a bullish flag and pole pattern in the daily timeframe, a classic signal of trend continuation. Simultaneously, within this pattern, there’s the formation of a W pattern, adding to the bullish indications. For confirmation, a breakout above the resistance zone of 0.6575 Euro is eagerly awaited. Once this breakout occurs, it opens the door to potential targets at 0.6909 Euro and 0.7194 Euro.

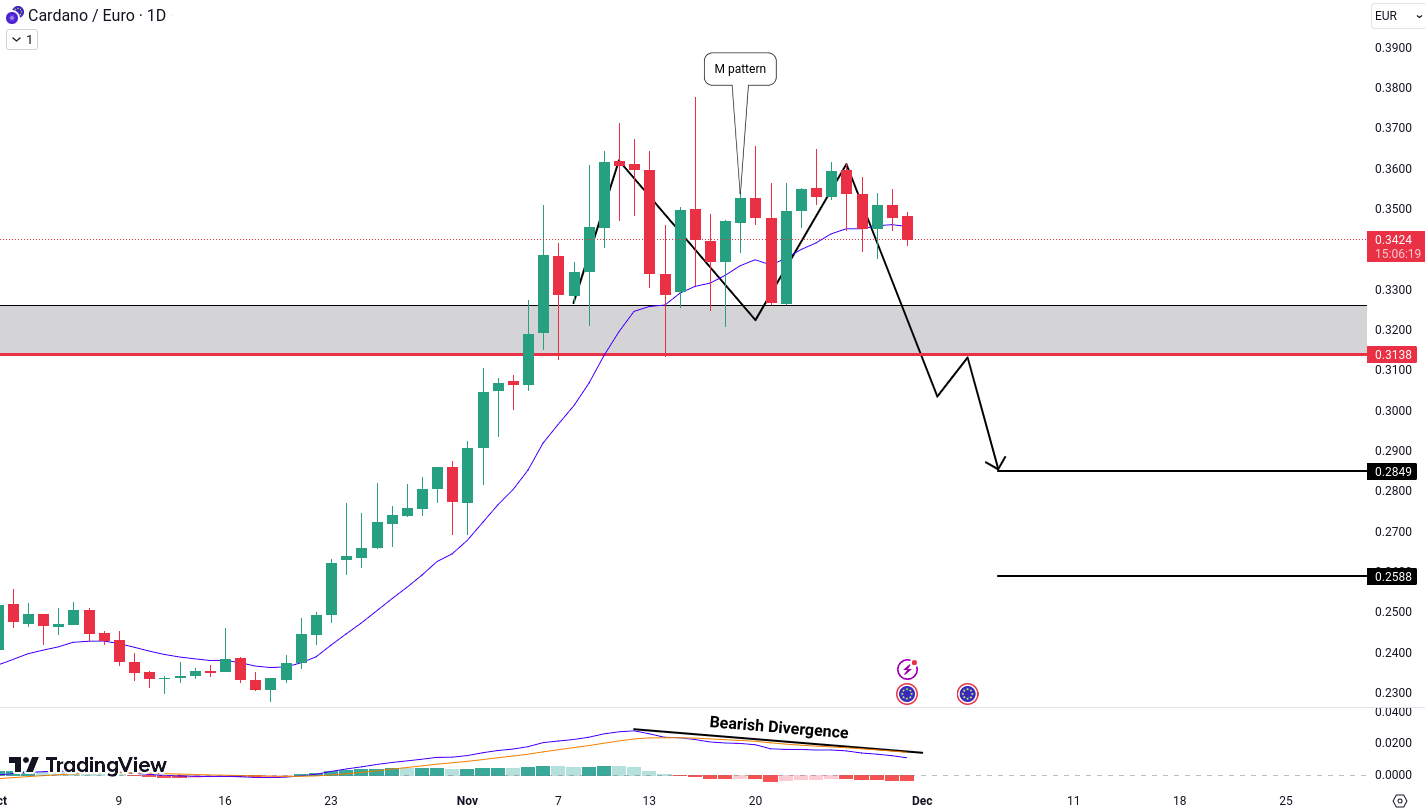

Cardano (ADA) Analysis

ADA/EUR has formed an M pattern on the daily timeframe with a bearish divergence in the daily timeframe, increasing the probability for bearish movement. To confirm this bearish outlook, we need a breakdown below the critical level of 0.3138 Euro. A successful breakdown could pave the way for further declines, targeting levels around 0.2849 Euro and 0.2588 Euro.

Do you agree with our analysis and interpretation?

Want to learn more or have a different perspective?

Let's discuss it in the Tradesilvania community 👉 Telegram Group

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy, or sell any of these cryptocurrencies using the free digital wallet.

SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 100 cryptocurrencies, are all available trought our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.

Total or partial reproduction of this report is permitted only by mentioning the source.