Crypto Market update and analysis for BTC, ETH, EGLD, XRP & SHIB - November 17, 2023

Crypto market in the last 24h:

💹 Total crypto market cap: €1.27T (↓2.02%)

🏪 Total volume 24h: €60.4B (↓11.47%)

✨ DeFi: €7.23B (11.98%)

💵 Stablecoins: €53.86B (89.17%)

💪 Bitcoin dominance: 51.37% (↑0.48%)

Bitcoin (BTC) Analysis

In recent days, BTC/EUR has exhibited significant price volatility, posing challenges in its analysis. As traders, maintaining discipline and adhering to our strategy is crucial during periods of high uncertainty. Currently, BTC is forming a pattern resembling the letter 'M,' traditionally considered a bearish signal. To confirm this bearish scenario, we'd look for a breakdown below the critical support level of €31,613, potentially indicating target levels at €29,932 and €29,032.

However, if BTC manages to surpass the resistance level of €35,156, a bullish move might be on the horizon. The rationale behind this optimism lies in the previous consolidation, suggesting the presence of numerous retail traders. Anticipating a bullish move, we might set targets around €36,249 and €37,055.

Ethereum (ETH) Analysis

ETH/EUR appears to mirror BTC's price action but with an interesting 'M' pattern formation. The top of this pattern is lower than the left side, indicating a potentially stronger bearish sentiment on ETH compared to BTC. To confirm this bearish scenario, we'd watch for a breakdown below the critical support level of €1,764. Such a breakdown could open the path to targets around €1,680 and €1,617.

On the other hand, for a more optimistic view, we'll monitor an exit above the resistance at €2,004. If ETH manages to break this level, it might signal a potential move towards targets around €2,119 and €2,188. As always, flexibility in our analysis is key to adapting to the evolving market dynamics.

MultiversX (EGLD) Analysis

EGLD/EUR is currently on a bullish trend, but the current formation of an 'M' pattern suggests a potential reversal to a bearish sentiment. However, it's crucial to note that if this pattern doesn't materialize, it might indicate a consolidation phase, possibly setting the stage for a flag and pole pattern - a bullish continuation pattern. To confirm a bullish scenario, we'll closely watch for an exit above the resistance at €49.96. Such a move could open up targets around €55.17 and €59.22. Conversely, for a bearish turn, a breakdown below the critical support level of €36.66 would confirm the 'M' pattern, with potential targets at €31.67 and €27.81.

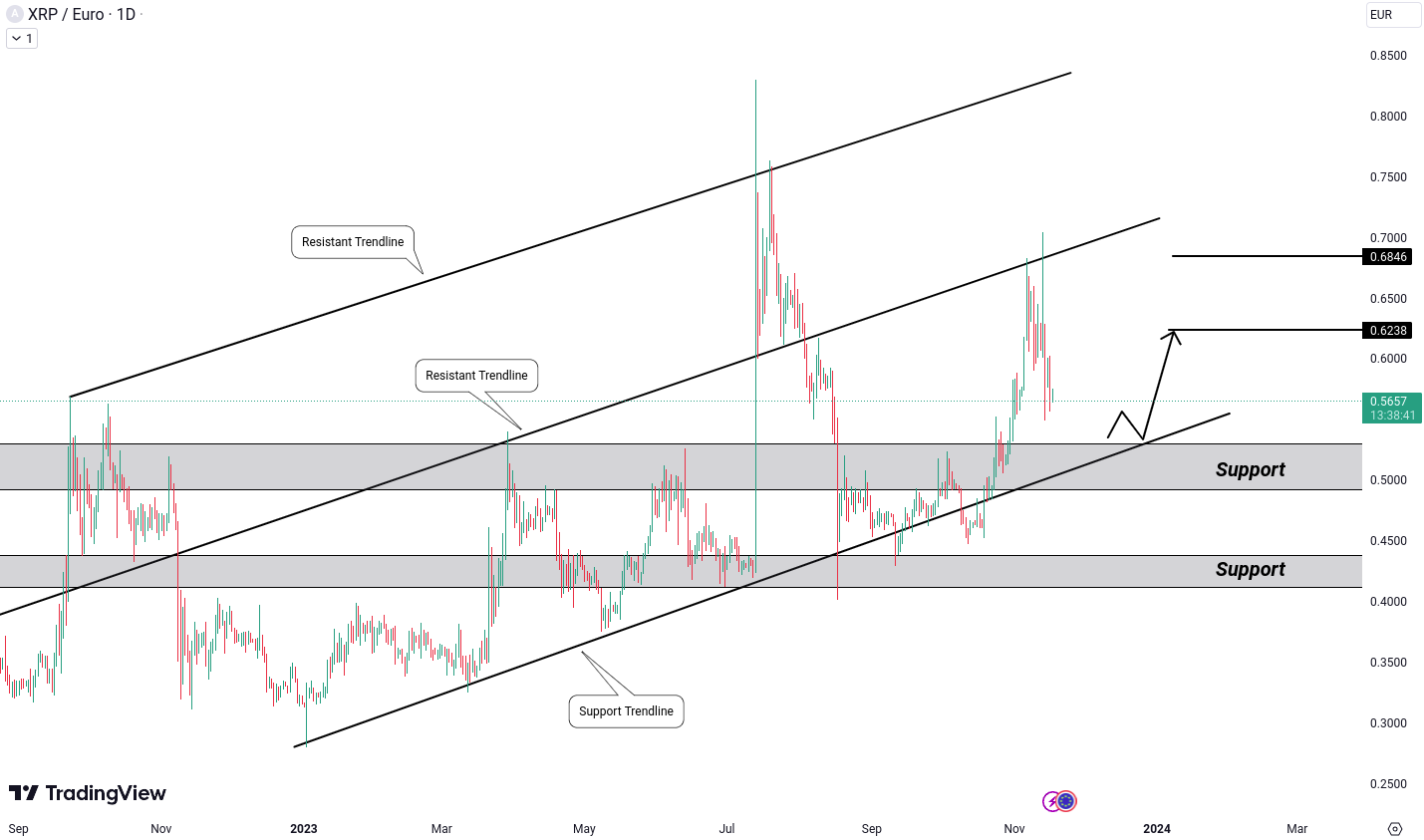

Ripple (XRP) Analysis

XRP/EUR seems to be entering an accumulation phase, making it an interesting prospect for long-term investments. For those who missed buying at lower levels, an opportunity could be on the horizon as XRP approaches its support zones.

Support levels around €0.5000 and €0.4556 are particularly noteworthy for potential accumulation. The €0.5000 level, in particular, holds significance due to the presence of a support line and historical support. This creates an attractive entry point for both long-term investors and scalpers.

For short-term gains, scalping opportunities may arise at these lower levels. For swing traders, potential targets could be around €0.6238 and €0.6846. It's worth mentioning that upcoming events, such as halving, could impact the crypto market. Historically, cryptocurrencies have shown bullish trends around halving events, so keeping an eye on this could provide additional insights in the coming days.

Shiba Inu (SHIB) Analysis

SHIB/EUR is currently forming a 'W' pattern, aligning with the general bullish trend in the crypto market. This increases the likelihood of a bullish scenario for SHIB. Additionally, with the halving event on the horizon, better opportunities might emerge.

To confirm the 'W' pattern, we're looking for a price movement above the level of €0.00001027. If this breakout occurs, it could pave the way for targets at €0.00001176 and €0.00001280. Keeping an eye on these key levels and the overall market sentiment is crucial for making informed trading decisions.

Do you agree with our analysis and interpretation?

Want to learn more or have a different perspective?

Let's discuss it in the Tradesilvania community 👉 Telegram Group

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy, or sell any of these cryptocurrencies using the free digital wallet.

SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 100 cryptocurrencies, are all available trought our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.

Total or partial reproduction of this report is permitted only by mentioning the source.