Declaratia Unica for crypto and NFTs earnings

In today's digital world, cryptocurrencies and NFTs have become a significant source of income for many. Because they represent income, they are taxable and must be reported accurately to tax authorities. In this article, we will discuss how to complete Declaratia Unica/Form 212 for income obtained from cryptocurrencies and NFTs.

What is the Declaratia Unica?

Declaratia Unica is a tax form that must be completed by all taxpayers who earn income from independent sources, including trading cryptocurrencies and selling NFTs.

This form is used to calculate and pay the taxes owed to the state. For the fiscal year 2023, the deadline for submitting Declaratia Unica is May 27, 2024.

What cryptocurrency and NFT earnings should be declared?

Earnings becomes taxable when virtual currency is exchanged into FIAT currency (Lei, Euro, etc.).

Income tax is calculated by applying a rate of 10% to the profit realized, determined as the positive difference between the selling price and the purchase price, including transaction fees.

In simpler words, subtract the purchase price and transaction fees from the selling price of the cryptocurrency or NFT to determine your profit.

If you received cryptocurrency or NFT as a donation, gift, or through airdrops, affiliate or savings programs, the purchase cost is considered zero.

On the other hand, if you are a NFTs creator, the earnings obtained from their sale are considered earnings from intellectual property rights, and are taxable.

Earnings below 200 lei per transaction are not taxed if the total earnings in a fiscal year do not exceed 600 lei. Even if you haven't reached the 600 lei level per year but had a transaction from which you made over 200 lei, it is subject to taxation.

The earnings must be declared in Declaratia Unica in lei. To convert to lei, you need to use the annual average exchange rate of the National Bank of Romania (BNR) for the fiscal year in which the earnings were made, in our case, 2023.

For 2023, the annual average exchange rate of BNR is 4.9465 lei for 1 euro.

How to complete Declaratia Unica

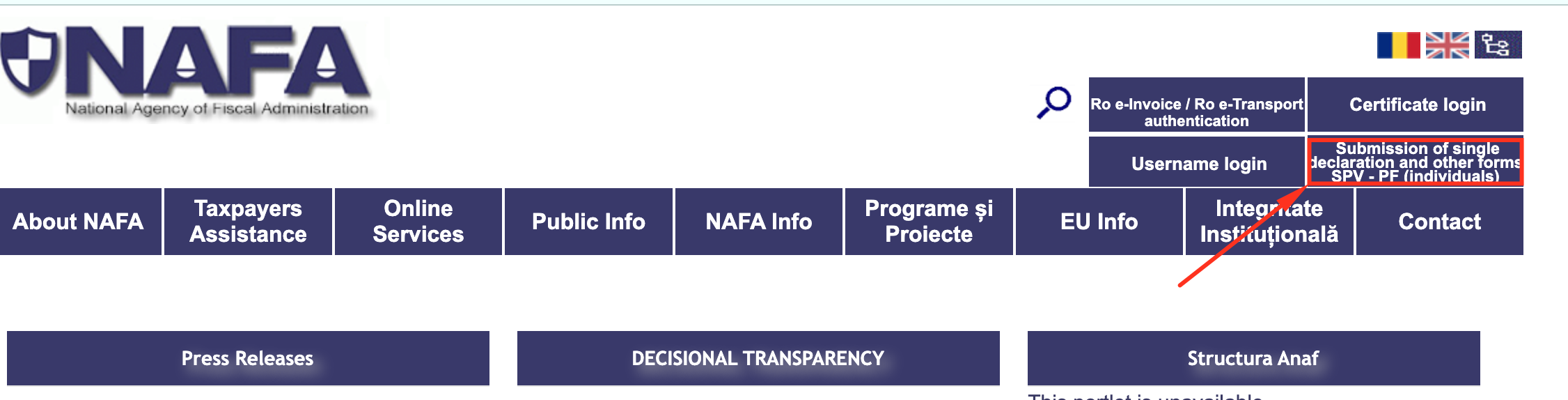

The declaration must be completed in smart PDF format and can be downloaded from the ANAF website. Open it by right-clicking and selecting Open with then choose Adobe Acrobat Reader.

In the video below, we will show you how to complete Declaratia Unica for income from cryptocurrencies and the sale of NFTs (whether you sold NFTs created by you or just bought and sold them).

What other taxes do you need to pay?

If you have income from cryptocurrencies or NFTs greater than 6, 12 or 24 gross minimum wages (the gross minimum wage for the year you are declaring), you will pay CASS (Health Insurance Contribution), equivalent to 10% of 6, 12, or 24 gross minimum wage.

For 2023, the gross minimum wage nationwide is 3000 RON.

CASS:

- earnings over 6 gross minimum wages: 3000 RON x 6 months = 18,000 RON

CASS: 10% x 18,000 RON = 1,800 RON - earnings over 12 gross minimum wages: 3000 RON x 12 months = 36,000 RON

CASS: 10% x 36,000 RON = 3,600 RON - earnings over 24 gross minimum wages: 3000 RON x 24 months = 72,000 RON

CASS: 10% x 72,000 RON = 7,200 RON

Where to submit Declaratia Unica

The declaration is submitted electronically, in accordance with the applicable legal provisions:

- through the "Private Virtual Space" service, available on the www.anaf.ro portal;

- through the "Submission of Statements" service, available on the www.e-guvernare.ro portal based on the qualified digital certificate;

- the declaration can be submitted in paper format, directly to the tax authority's registry or by mail, with acknowledgment of receipt.

Your transactions report on Tradesilvania

The Reports function on the Tradesilvania Platform allows you to quickly customize and generate detailed reports for the last 2 years, including 2023, report necessary for completing Declaratia Unica.

For more information on how to get the transaction report for 2023 from Platform Tradesilvania, click here.