Since cryptocurrencies are a source of income for many, they are taxable and must be properly reported to the tax authorities. In this article, we’ll discuss how to complete the Single Tax Declaration/Form 212 for income earned from cryptocurrency trading.

1. What is Declaratia Unica?

Declaratia Unica (Form 212) is a tax form that must be completed by all taxpayers who earn income from independent sources, including cryptocurrency trading.

This form is used to calculate and pay the taxes owed to the state. For the 2024 fiscal year, the deadline for submitting Declaratia Unica is May 26, 2025.

2. What cryptocurrency income needs to be declared?

Gains become taxable when virtual currencies are exchanged for FIAT currency (RON, EUR, etc.).

The income tax is calculated by applying a 10% rate to the profit made, determined as the positive difference between the selling price and the purchase price, including any direct transaction costs.

Simply put, you subtract the price at which you bought the cryptocurrency and the transaction fees from the price at which you sold it. The resulting amount is your taxable gain.

If you received cryptocurrency as a donation or gift—either from someone personally, through an airdrop, or via affiliate programs and savings services—the purchase price is considered to be zero.

The gain must be reported in RON in the Declaratia Unica.

To convert your earnings into RON, you’ll need to use the average annual exchange rate published by BNR (the National Bank of Romania) for the fiscal year in which the gains were made — in this case, 2024. For 2024, the average annual BNR exchange rate is 4.9746 RON for 1 EUR.

3. How to complete Declaratia Unica

Declaratia Unica must be filled out using the smart PDF format, which can be downloaded from the ANAF website. After downloading, right-click the file, choose „Open with”, and select Adobe Acrobat Reader.

In the video below, starting at minute 44:30, you can see a step-by-step guide on how to complete Declaratia Unica specifically for income from cryptocurrency trading.

4. What other taxes do you need to pay?

According to Romanian tax legislation (the Fiscal Code), income from the transfer of virtual currency (including the sale or conversion into RON/EUR/other currencies) is classified as “Income from other sources” – Article 114 of the Fiscal Code.

For income earned in 2024 and declared in 2025 through Declaratia Unica, the thresholds for mandatory social contributions in Romania are based on the gross minimum wage, which was 3,300 RON in 2024.

What does this mean for CASS and CAS?

✅ CASS (10%) – applies. CASS is owed if your income exceeds the following thresholds:

- Under 6 gross minimum wages (under 19,800 RON) – you pay 0 RON

- Over 6 gross minimum wages (over 19,800 RON) – you pay 1,980 RON

- Over 12 gross minimum wages (over 39,600 RON) – you pay 3,960 RON

- Over 24 gross minimum wages (over 79,200 RON) – you pay 7,920 RON

❌ CAS (25%) – does not apply. CAS is only paid for independent activities, copyright rights, etc. Cryptocurrency income is not included here, so you do NOT owe CAS for gains from cryptocurrencies.

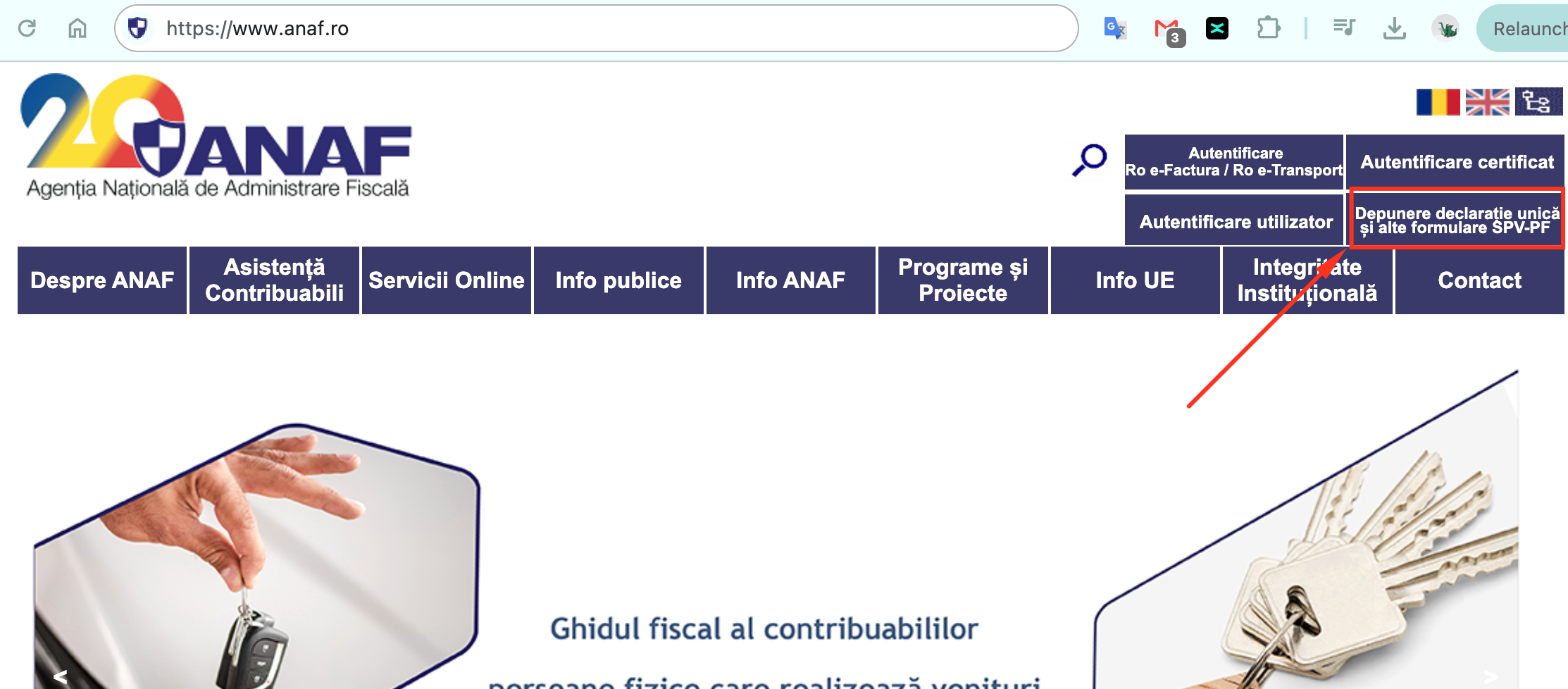

5. Where do you upload Declaratia Unica?

The declaration is submitted electronically, in accordance with the applicable legal provisions, namely:

- through the ANAF service – „Spatiul Privat Virtual” (Private Virtual Space), available here.

- Through the service „Depunere declarații„ (Declaration Submission), available on the portal www.e-guvernare.ro, based on a qualified digital certificate;

- the declaration can also be submitted in paper format, directly at the fiscal authority’s registry or by mail, with acknowledgment of receipt.

6. Your Tradesilvania Transaction Report

The Reports feature on the Tradesilvania Platform allows you to customize and quickly generate detailed reports for the last 2 years, including 2024. This report is necessary for completing your Declaratia Unica income statement.

You can find more information on how to download your 2024 transaction report from the Tradesilvania Platform here.