Market update and analysis for BTC, ETH, EGLD, SOL and ALGO - May 30, 2024

Crypto Market in the last 24h:

🌐 Global market cap: $2.5T (-1.77%)

📊 Total volume 24h: $83.02B (-8.54%)

🔗 DeFi volume: $6.39B (7.69% of total)

💰 Stablecoins volume: $77.79B (93.69% of total)

⚡ Bitcoin dominance: 53.00% (+0.57%)

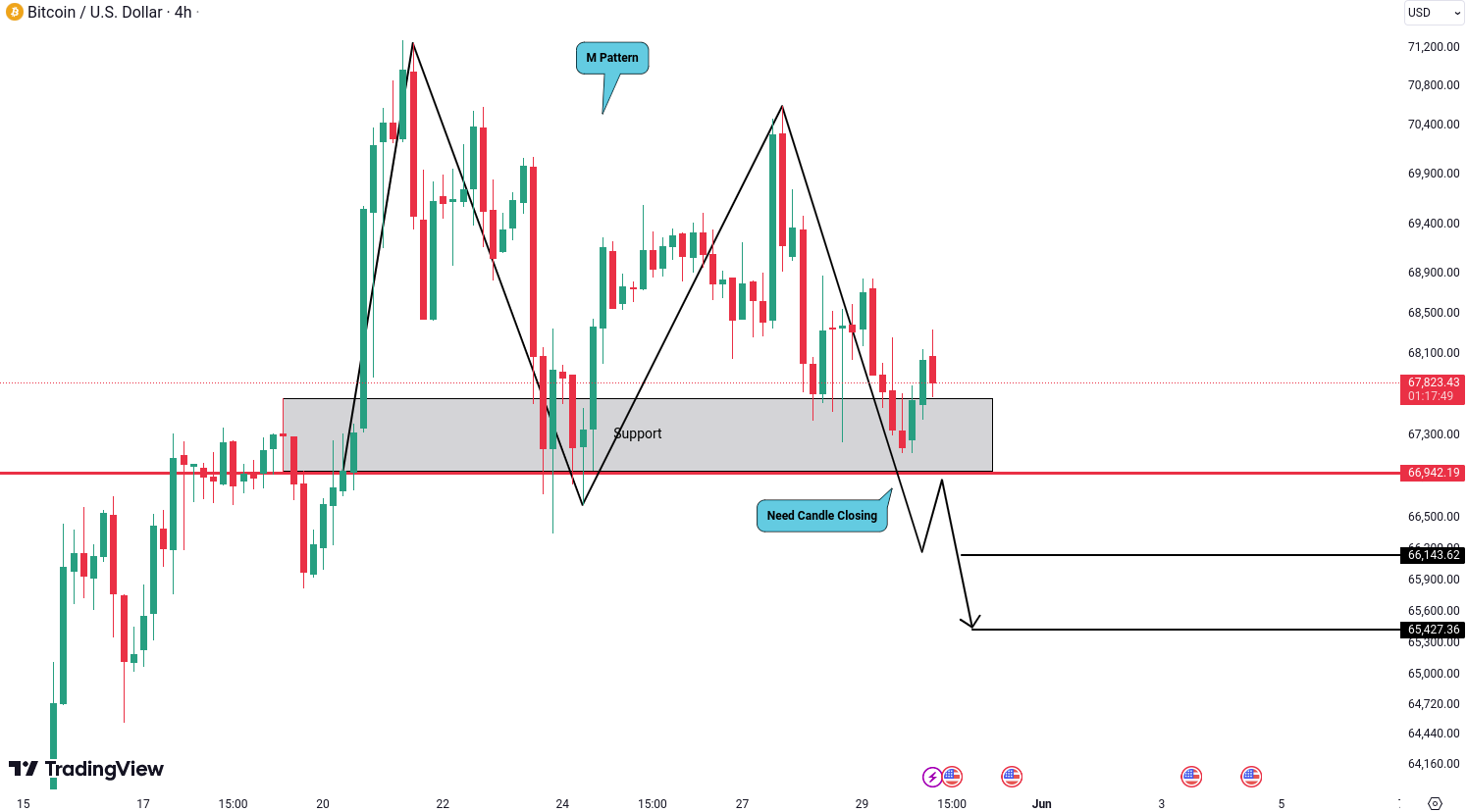

Bitcoin (BTC) Analysis

BTC has formed an M pattern, a bearish reversal indicator. We need a breakdown and candle closing below the crucial level of 66,942 USD to confirm this bearish pattern. This confirmation likely leads to further declines towards the targets of 66,143 USD and 65,427 USD.

Ethereum (ETH) Analysis

ETH is displaying bearish signals with a trap followed by the formation of an M pattern. Despite the right top being higher than the left top, the MACD is showing a bearish divergence, indicating weakening bullish momentum and increasing the probability of a bearish move.

For confirmation of this bearish outlook, we need a candle closing below the support zone at 3,659 USD. This breakdown would validate the M pattern and likely lead to further declines towards the targets of 3,579 USD and 3,512 USD.

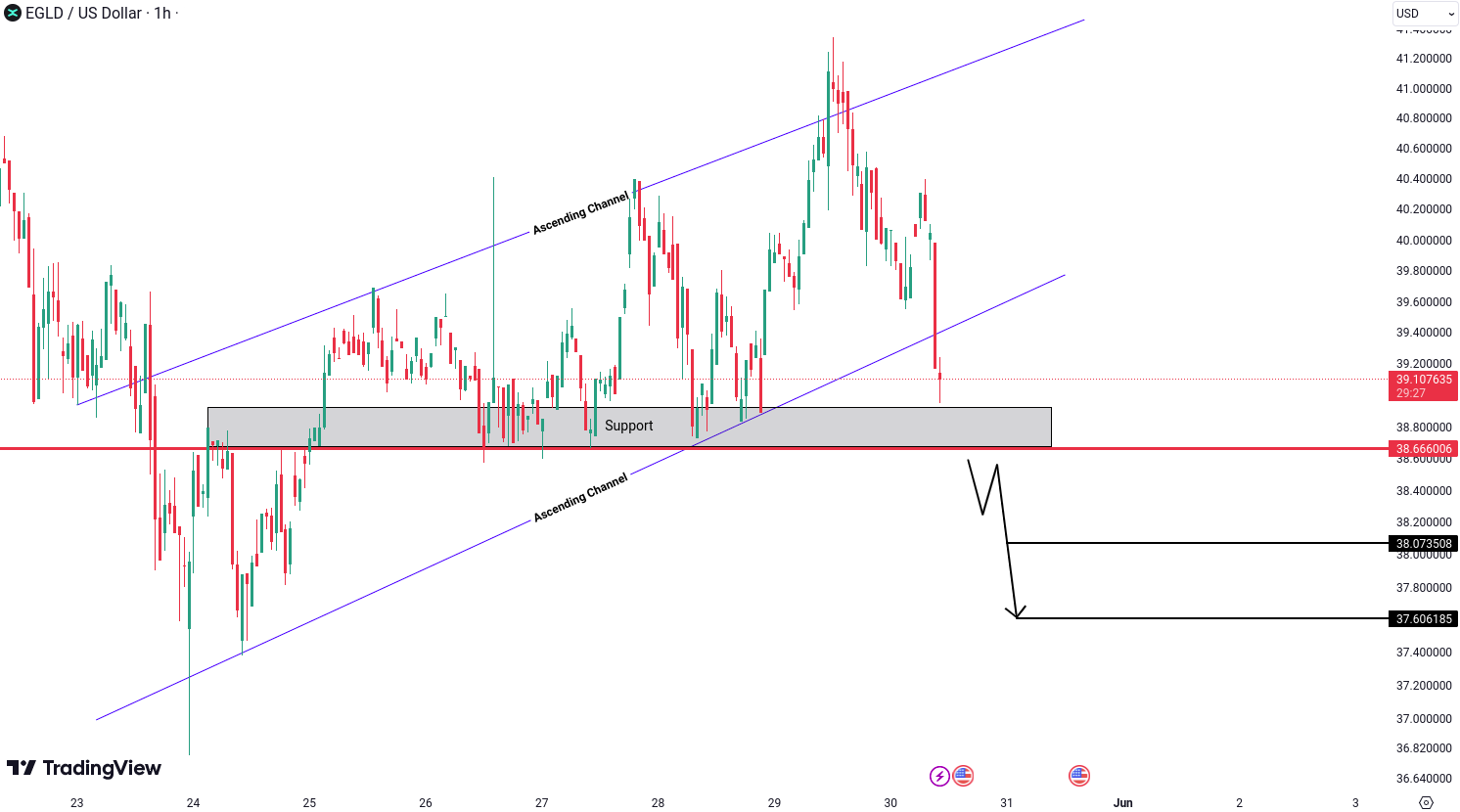

MultiversX (EGLD) Analysis

EGLD has formed an ascending channel, which is typically considered a bearish pattern. This pattern suggests that while the price is rising, it is likely to reverse and move lower once the channel support is broken.

For confirmation of the bearish outlook, we need a breakdown below the key level of 38.66 USD. This breakdown would validate the bearish pattern and likely lead to further declines towards the targets of 38.07 USD and 37.60 USD.

Solana (SOL) Analysis

SOL has formed a head and shoulders pattern, a classic bearish reversal pattern. Despite the bullish divergence, this pattern increases the probability of a bearish move if confirmed.

To confirm this bearish outlook, we need a breakdown and candle closing below the critical level of 165.85 USD. This confirmation would likely lead to the targets of 163.97 USD and 162.14 USD.

Algorand (ALGO) Analysis

ALGO is exhibiting similar price action to SOL, having formed a head and shoulders pattern accompanied by bearish divergence. This combination increases the likelihood of a bearish move if confirmed.

To confirm the bearish outlook, we need a breakdown below the critical level of 0.1878 USD. This confirmation would likely lead to further declines towards the targets of 0.1844 USD and 0.1815 USD.

All cryptocurrencies are available for trading on Tradesilvania , and their prices can be seen on the Tradesilvania price page, accessible through the following link: https://tradesilvania.com/en/prices

With the help of our platform, you can deposit, withdraw, buy or sell any of these cryptocurrencies using the free digital wallet. SEPA Top-up (On-Ramp & Off-Ramp) Euro and RON instant transfers and over 100 cryptocurrencies, are all available in our app.

Limitation of Liability

This report issued by Tradesilvania is purely informative and is not intended to be used as a tool for making investment decisions in crypto-assets. Any person who chooses to use this report in the process of making investment decisions assumes all related risks. Tradesilvania SRL has no legal or other obligation towards the person in question that would derive from the publication of this report publicly.

The content provided on the Tradesilvania website is for informational purposes only and should not be considered as investment advice, financial advice, trading advice, or any other form of advice. We do not endorse or recommend the buying, selling, or holding of any cryptocurrency. It is important that you conduct your own research and consult with a financial advisor before making any investment decisions. We cannot be held responsible for any investment choices made based on the information presented on our website.

The information in this report was obtained from public sources and is considered relevant and reliable within the limits of publicly available data. However, the value of the digital assets referred to in this report fluctuates over time, and past performance does not indicate future growth.

Total or partial reproduction of this report is permitted only by mentioning the source.